Big players destabilize capital market: Finance Adviser

News Desk || risingbd.com

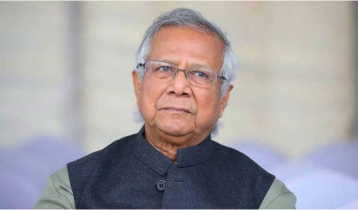

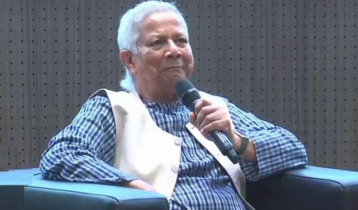

Financial Adviser Dr. Salehuddin Ahmed

Finance Adviser Dr. Salehuddin Ahmed has said that the big players' tactics and the inefficiency of regulatory authorities are the reasons that make instability in the country’s capital market.

The adviser said this as the chief guest while unveiling the sixth edition of ‘Banking Almanac’, a book of information on banks and financial institutions of the country at the CIRDAP auditorium on Saturday.

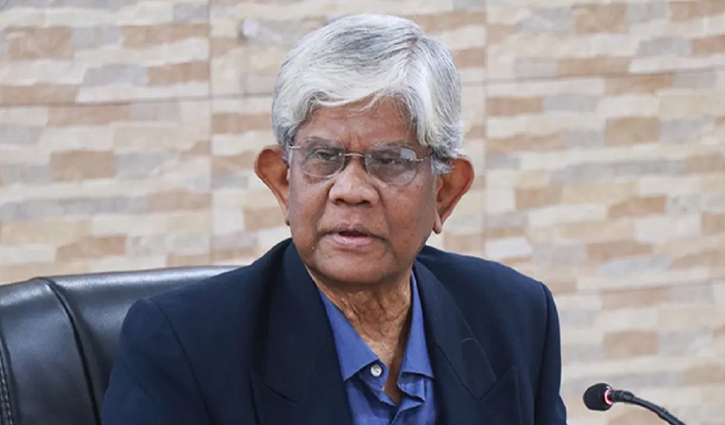

Finance Secretary Dr. Md Khairuzzaman Mazumder attended the event as the special guest while acting chairman of the board of editors of Banking Almanac Dr Hossain Zillur Rahman was in the chair.

He said, “Investors invest in the capital market for profit. However, due to the manipulation of a few big players and the inefficiency of the capital market regulatory authorities, instability occasionally occurs in the capital market. Many investors are buying Z category shares, which do not exist. They protest only when the share price decreases. There is no option but to throw these shares in the dustbin.”

“More problems will be created if we cannot manage information properly. We need to update the information. Measures cannot be taken with data that are 10-15 years old,” the adviser said.

Salehuddin said the Bangladesh Bureau of Statistics (BBS) has been asked to refrain from exaggeration but remain careful about publishing the actual data.

“Now there is no deception while releasing data on share market, baking and financial sectors,” he added.

Salehuddin said the interim government, out of its responsibility, is trying to bring necessary changes and reform the data catastrophe.

“The foremost important issue for us is to restore financial discipline to keep the wheels of the macro economy moving forward,” Dr Zillur Rahman said adding that the second important thing is to maintain the data authenticity.

Hasan/Mukul