‘Interest rate on savings certificates to be cut after budget’

5 || risingbd.com

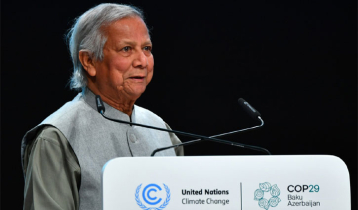

Special Correspondent: Finance Minister AMA Muhith is set to place a mega budget of around Tk 468,200 crore in Parliament on Thursday for the fiscal year 2018-19.

The finance minister is going to set a rare example by placing the 10th consecutive budget of the current government. He will place the budget at 12:30pm on June 7.

Muhith indicated that the interest rate on savings certificates will be reduced after the budget.

In terms of interest rate on savings certificates, we try to keep 1 to 1.5 percent more than the rate existing in the market. But the rate has now increased more. It must be reviewed after the budget announced, said the finance minister while discussing the upcoming budget with journalists at his ministry on Monday.

The revenue collection target for the coming fiscal year is likely to be fixed at Tk 340,775 crore, up 18 percent from that of the current fiscal year. The revenue collection target for fiscal 2017-18 is Tk 287,990 crore.

Finance Ministry officials said the revenue target will be fixed in such a way so that the budget deficit remains within 5 percent.

The allocation for annual development programme (ADP) for the coming fiscal year is likely to be Tk 178,2960 crore, up from the outgoing fiscal year.

The government is likely to set the GDP target for the upcoming fiscal year at 7.8 percent, said an official.

There might be an announcement to bring more people under social safety net programme in the next budget, officials said.

There is an indication that there will be another announcement for freedom fighters on enhancing their facilities.

There is also an indication that there will be announcement for Rohingyas on enhancing their facilities.

The finance minister indicated that the tax rate will be reduced as the number of taxpayers is on the rise.

He also indicated that corporate tax rate will also be reduced as the young generation is showing a growing interest in paying income tax.

The government is taking necessary steps to form banking commission soon in an effort to look into the reason behind the current vulnerable situation in the financial sector. It is likely to be placed in the upcoming budget.

The government will put emphasis on boosting domestic investment as the government thinks foreign investors will not be interested to invest in Bangladesh if the domestic private sector investors do not come forward.

The finance minister is likely to highlight the issue in his budget speech as he thinks the investment climate has improved creating confidence among investors.

He will also highlight steps to strengthen the country’s capital market.

risingbd/Dhaka/June 4, 2018/Hasnat/AI

risingbd.com