No harassment in getting Probashi Kallyan Bank loans: Koeys Sami

Augustin Sujan || risingbd.com

Niaz Mahmud (L) is taking interview of CM Koyes Sami

Bangladesh Government has launched `Probashi Kallyan Bank` (Expatriate Welfare Bank) in 2011 aiming to assist and welfare the expatiates of Bangladesh.

The main goal of opening the bank was to provide various monetary facilities for Bangladeshi expatriates along with earn remittance income safely through the banking channel. Besides, the Bank has been offering loans at Tk 9% interest within three days for those people who want to go abroad as Bangladeshi wage earner. This is a unique banking instance across the world. The Probashi Kallyan Bank`s Managing Director (MD) also Chief Executive Officer (CEO) CM Koyes Sami has talked intensively with the Risingbd over the overwhelming success story of the `Probashi Kallyan Bank`. Our Economic Correspondent Niaz Mahmud interviewed him. Main part of the interview has been placed here for our valued readers.

Risingbd: Would you please brief the prime job of Probashi Kallyan Bank?

Koyes Sami: The Probashi Kallyan Bank has been working provide better service for those Bangladeshi people who are already become expatriate and want to be expatriate. After returning from the foreign countries, we offer bank loan for them for employment generation. They were given two year tenure to refund the loan. Through operating the banking, many people have involved with the operation and paying loan installment smoothly from other countries.

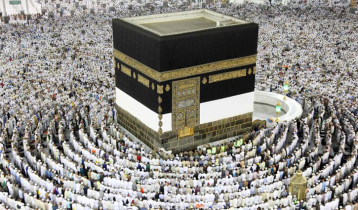

Besides, the bank has been offering facilities in the field of assisting manpower exportation in different counties of the world, offering banking facilities to Bangladeshi immigrants, migration loan (without deposit) for future migrants from Bangladesh, create investment friendly environment for migrants, inspire them to invest and sending the remittance through banking channel in a lower rate through introducing and using developed technology.

Risingbd: Other banks of Bangladesh also providing such loan facilities. What are the differences the Probashi Kallyan Bank with other banks?

Koyes Sami: People who want to go abroad for earning, are getting loan at the rate of TK 9 percent interest. The facility is offered by only this bank. Other bank cannot provide this bank interest rate. Beside we can manage loan money at swiftest span of time than other banks in Bangladesh.

Risingbd: What are the pre-requisite to get loan from your bank?

Koyes Sami: The applicant has to give photocopies of employer and visa papers and applicant`s mobile phone number. After verification of the visa application within three working days by bank, we will confirm him through SMS or mobile phone service. In absence of loan applicant, the relatives of the applicant should have to pay loans. The guarantors of the applicant must have enough financial solvencies.

Risingbd: After getting verification of visa, which papers should be submitted by loan applicant?

Koyes Sami: Before receiving the loan from the bank for migration, the applicant has to fill up an application forms that to be submitted to the Bank`s managing director or manager. The applicant will submit three copies of recent passport size photographs, attested photocopy of National ID card, photo copy of passport, present address and permanent address with nationality certificate issued by local union council chairman or municipality.

During receiving the loan money, the applicant has to open a savings account in the bank. It should be remember that all remittance must be sent in the country through the savings account of our bank channel from aboard.

Besides, the applicant is bound to open Insurance facilities with the bank during taking loan. The applicant also has to provide Visa from issued by respective embassy and photo copies of labor contactor (that includes the salary information) and translated photocopy of visa and certificate of BMET. In the same time, if available, the photocopies of academic qualification certificates also have to provide in the bank by the applicant.

Risingbd: Would you please inform me over the fees and rules of paying migrant loan?

Koyes Sami: The interest rate for migration loan has been fixed only 9 % in our bank. The grace period is given highest two months here. The loan should be paid through 23 monthly installments. In case of Singapore, the loan have to pay within 11 month installment as per visa durations is expired.

Risingbd: How many applicants were given migration loan after launching your bank?

Koyes Sami: Around 4000 people were given each Tk one lakh loan from our bank and the loan recovery rate is more than 95%.

Risingbd: Which initiatives you have been launching to increase consumers service?

Koyes Sami: We have opened 40 bank branches in different areas of Bangladesh to provide loan and sending remittance. Three booths of the bank have been opened in the three international airports. We have planned to open more branches to expand our operation.

Risingbd: Have you any initiative to collect remittance through direct channel?

Koyes Sami: Our bank has been operating as specialized bank. But due to a specialization rules by the central bank our bank yet to launch remittance facilities. For this reason, we have applied to the Bangladesh Bank seeking collection of remittance from migrated Bangladeshi. We are hoping the Bangladesh Bank will consider our appeal positively.

Risingbd: The Bank was installed to providing loan to those people who want to go in foreign countries. Why you are now expressing interest of remittance facilities?

Koyes Sami: The Probashi Kallayen Bank is now directly working to build a digital Bangladesh. We want to collect remittance aiming to speed up the digital Bangladesh program of the government. Due to various reasons, a portion of foreign Bangladeshi is sending money beside the banking channel. If we offer the support at minimal cost as a government bank, the migrant people will be inspired to send their money through banking channels. To sustain in the competitive market, other banks will also offer remittance support at a limited cost. Risingbd: What more planning of you for the Probashi Kollayan Bank?

Koyes Sami: The Probashi Kollayan Bank will be turned into a largest bank in Bangladesh. I will do for the best to fulfill the dream as a leading bank in the country.

Risingbd: Thanking you for offering time to Risingbd.

Koyes Sami: Thanking you to risingbd families too.

Risingbd/Sept 8, 2014/ Niaz/Tipu/Santosh/ SM Humayun Kabir

risingbd.com