Recession in property market

Manzurul Alam Mukul || risingbd.com

The price of property at the up-market is going through correction like the stock market, and has nosedived by one-third in recent times, according to developers, economists and bankers, according to developers, economists and bankers.

Sources say the property prices have dropped at Dhanmondi, Gulshan, Banani, Baridhara and Lalmatia by 15-20 per cent.

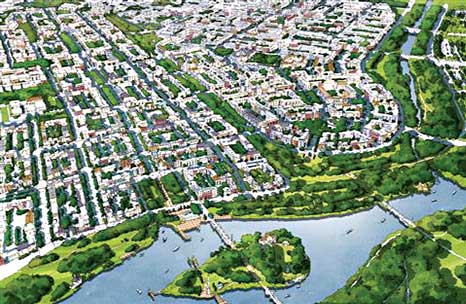

The property prices at Dhanmondi, Gulshan, Banani, Baridhara and Lalmatia sky-rocketed during 2009-2012. The land prices in posh area also dropped while the height restriction of the buildings has also been relaxed. Now the Rajdhani Unnayan Kartripakkha (Rajuk) relaxes the height at Dhanmondi, Gulshan, Banani, Baridhara and Lalmatia that also pushes prices of high-rise buildings. Even one or two years back, Rajuk permitted six-storey residential buildings at Dhanmondi, Gulshan, Banani, Baridhara and Lalmatia. Now developers can build 12-storey buildings in posh areas and in some locations even 16-20 storied buildings.

Besides, the real estate sector of the country is facing another setback due to the ongoing political turmoil. If violence lasts long, the crisis in the sector will deepen, experts opine.

At the beginning of early 1980s, the number of real estate developing companies was less than 10. The number increased to 42 in 1988. The number of real estate developers was 200 in 2000 that shot up to 1500 in 2011. The real estate sector now contributes around 7 per cent to the country`s gross domestic product, employing around one lakh skilled people and another 35 lakh in linkage industries, according to industry people.

The sector is going through turmoil as the sales have dropped nearly 20-25 per cent in recent times. A number of companies have experienced more than 40--50 per cent drop in sales over the last months. Many realtors have started terminating their employees to reduce expenditure under the changed circumstances.

At a press conference, the Real Estate and Housing Association of Bangladesh (REHAB) says that the sector faced losses of nearly Tk 1,656 crore in the first 45 days of countrywide hartal and blockade that began on January 5.

“Currently, there is Tk 24,000 crore investment in the country’s housing sector and lakhs of workers are employed in this sector, whose livelihoods is now under threat due to the prolonged political unrest,” the REHAB president says at the press conference.

According to a recent study conducted by REHAB found that the number of new projects undertaken by developers declined by around 75 per cent in 2015 compared to the previous year. A significant drop happened in the new project registrations in 2015. The REHAB study found that a total of 338 companies have 22,572 units of unsold flats.

According to the study, land price in Dhaka also fell on an average 14.12 per cent year-on-year. Land owners are now selling each katha at Tk 1.94 crore on average, down from Tk 2.26 crore in 2014. Baridhara has the highest price -- Tk 4.5 crore per katha, while Badda and Basabo have the lowest price -- Tk 35 lakh.

Vice-President of REHAB Liakot Ali Bhuyan says realtors find it challenging to build low-cost apartments, and working on economies of scale is the only way to bring down the apartment prices.

To reduce apartment prices, we have decided not to undertake any small projects. We now prefer projects where we can build more than 50 apartments at one site we are trying to get economies of scale. Big projects help minimise construction costs as developers can source materials at bulk rate and utilise the resources more efficiently, he adds.

In the recently held REHAB exhibition, a number of leading companies offer discounts up to 20-25 per cent on their projects as sales have dropped this year causing recession in the real estate sector. Even after offering attractive raffle draws and expensive gifts to the participants in the growing numbers of real estate fairs, the situation has not improved up to the expectation of the realtors.

The price for per square feet of apartments has come down to nearly Tk 14,000- 15,000 compared to the price of Tk 20-,000-22,000 even 2-3 years back in the city`s posh areas like Dhanmondi, Baridhara, Banani and Gulshan.

Dr Md Helal, a teacher of Economics Department of Dhaka University, says as demands have reached a saturation point, prices will be fixed at certain point after some correction.

Dr Md Helal who has worked nearly 11 years in the USA explains that investment in property market will give less profit than depositing money with the commercial banks. A person by renting a 2,000 square feet apartment who has bought the property at 4.00 crore may get taka 35,000-45,000 as house rent per month and taka 4,20,000-5,40,000 per year. But the same person may earn at least taka 35-40 lakh by depositing same amount of money with the bank(s).

Dr Md Helal says some persons bought the property in posh area with an expectation that prices will appreciate, but it has not happened.

The Southeast Asian economies experienced recession in 1997 when property prices of those economies nosedived. The boom in property market in Southeast Asian economies did not last and at certain period the market collapsed triggering recession. But in Bangladesh the same situation will not be repeated as the central bank has imposed a ceiling of investment in the property market, sources say.

If a price of commodity skyrockets, it has a chance of nose-diving. Prices of property have started adjusting and will be stabilized until new demands are created, an expert say.

The prices of property at parts of the city like Kalyanpur, Paikpara, Ahmednagar, Shukrabad, Shewrapara, Badda, Goran, Gopibagh, Shantibagh, Chamelibagh, Senpara, Gandaeria and Mirpur remains stable because of a large group of mid-income buyers.

According to newspaper reports some 40 per cent of the loans extended to the housing sector by commercial banks have become classified amidst slowdown in real-estate business during last couple of years.

Bankers are now deeply concerned at the future of the money their banks have invested in the sector. According the central bank statistics, the total outstanding bank loans of country`s real-estate sector was Tk. 355 billion until December 13, 2013. Of the amount, Tk. 81 billion was found to be bad, Tk. 32 billion substandard and Tk. 21 billion doubtful. The amount of bad loan to the sector was Tk. 50 billion only a year back and Tk. 40 billion in December 2011.

The number of buyers belonging to the upper-middle-income group like doctors, and high-salaried officials of multinational corporations has remained more or less stable. But, they say, what has hurt the real-estate business most is the decline in the number of expatriate buyers.

REHAB leaders say they target mainly expatriates, middle-income people and investors in the share market to boost their business.

They say the slow recovery of the US economy coupled with the prolonged recession in Europe has induced a sharp fall in the property business at home.

Bangladeshi expatriates and middle-income people were the main clients of the sector when it had experienced a boom period between 2005 and 2010, they say.

The property price sees a downward trend at the beginning of this year as purchasing power of the mid-income group has been squeezed, a REHAB member says.

Talking to risingbd CEO of Jahanabad Group AF Ubydullah Mamun says, there is a common tendency among Bangalis that when there comes a business opportunity, many people rush to take opportunity from that one.

When the real estate business began to flourish in our country, many businessmen got involvement with the hope of making more profit, creating heavy competition in the sector, he says.

Due to heavy competition in the sector, huge number of middlemen emerged, and they would take a portion of price, raising the figure of land price.

But in recent days, people have become aware of brokerage and they are directly buying land from the owners at real prices as a result prices of land are being seen low.

Managing Director of Sheltech Limited Toufic M Seraj demands that the present system of house loan with high interest rate should be restructured. In addition, as specialized bank (real estate Bank) should be set up to give long term house loan with low interest rate. The fees associated with property transfer and registration process now account for 9.5 per cent which should be lowered to 3.00 per cent by making necessary amendments in property transfer regulations.

Citing the personal professional works on the Dhaka city, Dr Amanat Ullah Khan, a professor of the geography department of the Dhaka University, says the price of land at Motijheel is higher than the price of land at Ginzain, a commercial hub of Tokyo city, way back in 1972.

One of the major hot spots to visit in Tokyo is the `Ginza`. This is a huge street of commercial complexes/restaurants, clubs, art galleries and bars. The entire street offers a wide range of entertainment and shopping activities.

He says as the investment opportunities are limited in Bangladesh, people have a natural tendency to invest in the property market to make sure that their money is safe.

The state should expand investment opportunities in the industrial and productive sectors. Communications system of the country should be developed so that people can come to Dhaka city and can get back after completing their tasks within a short time.

To reduce pressure on the Dhaka city, the government should decentralize the administration, and some other steps can help to overcome the the problem.

risingbd/DHAKA/Mar 9, 2015

risingbd.com